Senator Rand Paul Slams Uni-Party

Debt Crisis Drives Central Banks to Gold Over Failing U.S. Dollar

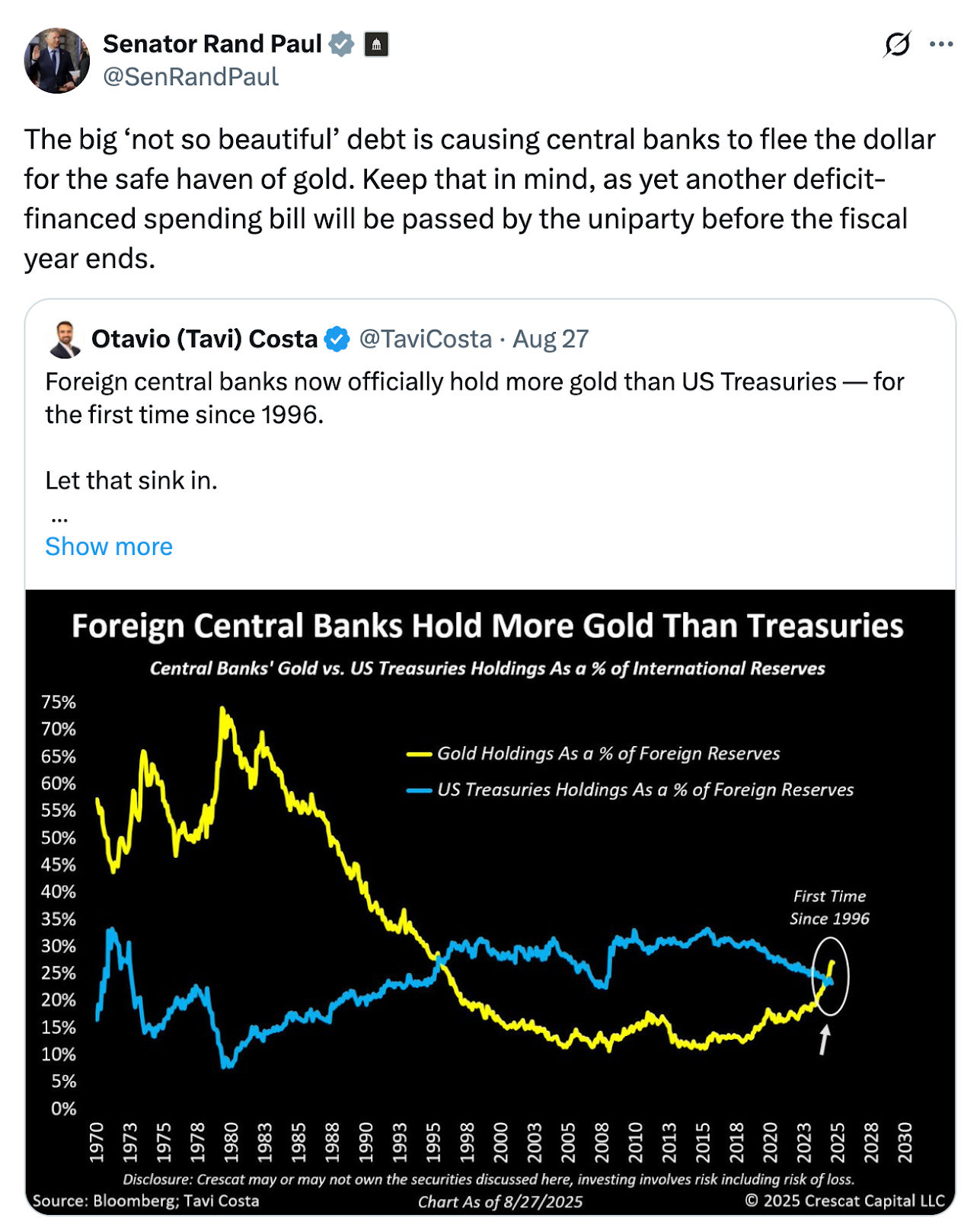

Senator Rand Paul often faces backlash for exposing the wasteful spending and mismanagement of taxpayer funds by the "uni-party" in Washington. He argues that the U.S. national debt, fueled largely by government waste, fraud, and abuse, is pushing major banks to favor gold over the dollar. Is this shift deliberate? Is the dollar's decline unavoidable? Since 1996, foreign banks have increasingly favored gold over U.S. Treasury securities, likely signaling a decline in confidence in the dollar.

The Surge in U.S. Debt

The U.S. national debt has surged from $370 million in 1970 to $37 trillion, a trajectory made worse by persistent budget deficits and loose monetary policies. Add to that the waste, fraud, and abuse the DOGE has just begun to uncover, and the ridiculous use of taxpayer funds, like $350 million worth of materials left sitting in a desert, paid for by the Biden regime, the $1.1 billion in wasteful spending by government agencies, or the FED burning through money on building pr…