Will Trump create a Bitcoin strategic reserve?

States are passing crypto-friendly laws as Trump signals he's ready to usher in a new era.

Something is stirring in America. (And no, it’s not Santa Claus.) From the Texas Strategic Bitcoin Reserve Act to a U.S. legislator exclaiming “Thank God for Bitcoin” on the Senate floor, to Donald Trump confirming plans to establish a U.S. Bitcoin strategic reserve, it is quite a time for cryptocurrency.

Along with Russia’s own push for a Bitcoin reserve, these developments have fueled speculation that Bitcoin’s price could skyrocket to $800,000 by the end of 2025, driven by its fixed supply and rapidly growing institutional acceptance. But make no mistake, what we are experiencing now is bigger than Bitcoin. It’s about reshaping the power of individuals within the global financial order.

Bitcoin: The antidote to monetary debasement

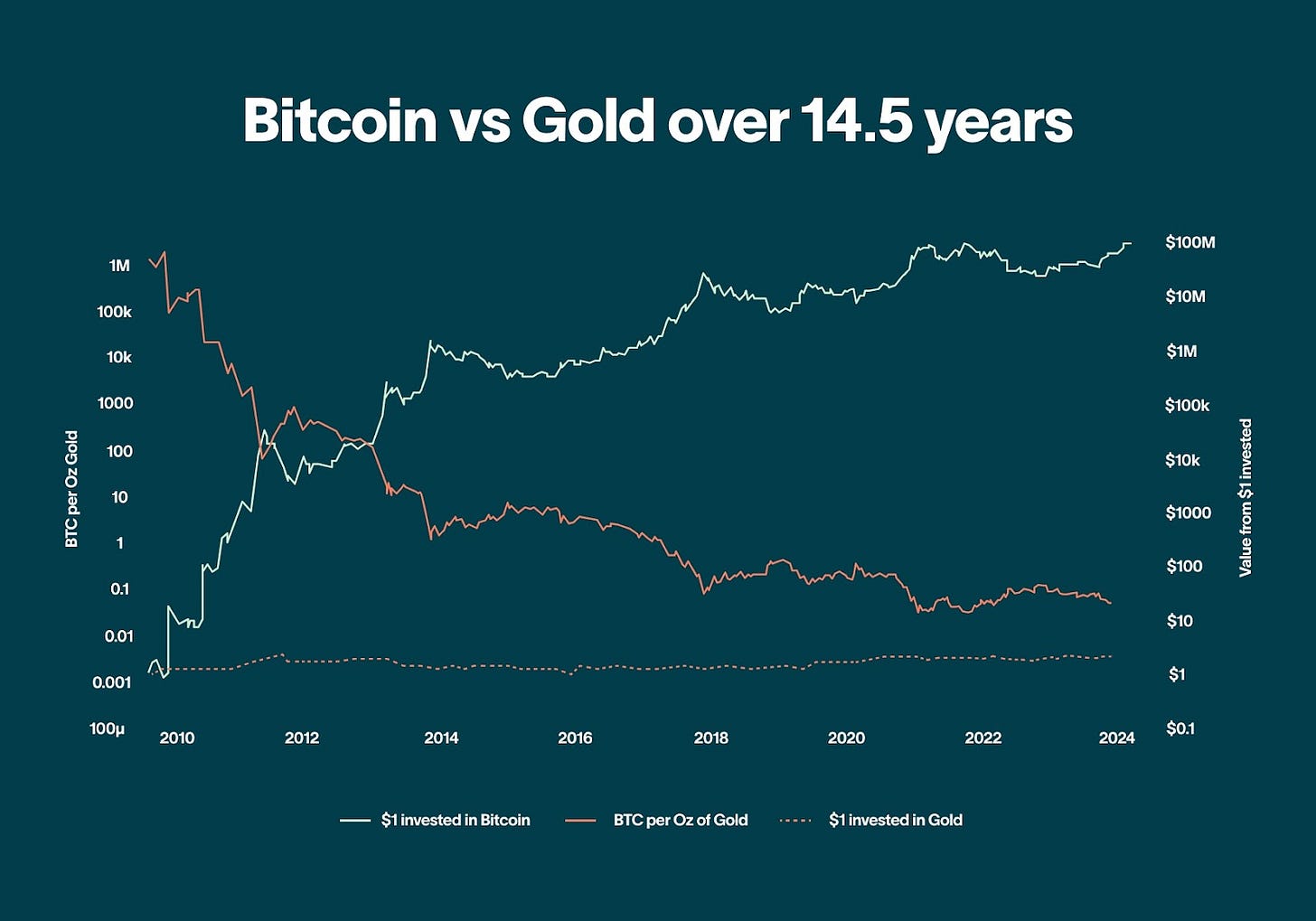

Bitcoin emerged as a response to the failures of traditional financial institutions and central banks, challenging the cycle of monetary debasement and inflation. Fiat currencies like the U.S. dollar are subject to unlimited printing. Gold mines mean that the gold supply increases with demand. Bitcoin, in contrast, is founded on absolute scarcity. It has a hard cap of 21 million coins. This fixed supply, along with a predictable issuance schedule, makes Bitcoin a robust store of value, a reliable hedge against inflation, and a decentralized system where users control their network and value.

Bitcoin mining: Securing the network, one calculation at a time

Bitcoin mining is the mechanism for both creating new bitcoins and validating transactions on the network. It’s more than just the creation of new coins, though; it's what ensures that the Bitcoin network remains secure and tamper-resistant. This isn’t achieved through brute force but through a computationally intensive process known as proof-of-work. Miners use specialized computers to solve complex cryptographic puzzles and verify transactions. Successful miners earn new bitcoins and transaction fees, incentivizing the maintenance of network integrity.

The Switzerland of payment networks

Bitcoin's potential extends beyond being a digital asset; it functions as an unstoppable, neutral payment network. Think of it like the “Switzerland of payment networks.” In an era of global volatility and shifting power dynamics, Bitcoin offers a system free from the control of any single government or corporation. Unlike the traditional SWIFT system, primarily dominated by the U.S., Bitcoin provides a decentralized and impartial platform for transactions, allowing anyone to transact freely, irrespective of their political, national, or personal affiliations.

Taking it to the States

With the rise of Bitcoin, it is becoming increasingly risky to be an anti-crypto legislator. This became clear in the 2024 Ohio Senate race, where blockchain entrepreneur Bernie Moreno defeated incumbent Senate Banking Chair Sherrod Brown. Brown was criticized by crypto supporters for opposing pro-crypto legislation and backing anti-crypto policies.

Crypto PACs poured an estimated $40 million into defeating Brown in Ohio, making it the largest target of crypto funding in this election cycle. Moreno’s victory was a huge victory for the crypto community, with figures like Tyler Winklevoss and Coinbase CEO Brian Armstrong celebrating the election of pro-crypto candidates. More than 219 pro-crypto candidates were elected to the House and Senate in 2024. The price of Bitcoin surged past $75,000 following the election results, as optimism soared with prospects of a more pro-crypto Congress.

Satoshi Action Fund

Then there are organizations like the Satoshi Action Fund. In June 2022, Founder Dennis Porter felt a growing unease among Bitcoin advocates about potential government overreach. He started Satoshi Action Fund with a strategy of concentrating on state-level advocacy.

As seen in the widespread adoption of pro-cannabis laws across the country, states have immense power to shape U.S. law. Inspired by the success of cannabis advocates, Satoshi Action Fund works to educate lawmakers on Bitcoin’s potential to strengthen state economies through financial resilience, grid stabilization, clean energy development, rural job creation, and budget protection.

In its first year, Satoshi Action Fund secured wins in Montana and Arkansas, protecting Bitcoin mining and ownership. Last year, they expanded their efforts and secured additional legislative wins in Louisiana and Oklahoma. These laws establish crucial rights for miners, self-custody, and peer-to-peer transactions.

These efforts are about influencing national policy, and their success with the GOP is only one piece of the puzzle. Many Democratic politicians, realizing they want to avoid becoming the next Sherrod Brown, are getting on board as well. That’s a good thing. As Satoshi Action Fund’s CEO Dennis Porter says:

“We don't want one party trying to get rid of it all the time. We want both parties supporting it, endorsing it, and doing everything to make sure that the United States is a leader on Bitcoin.”

A federal Bitcoin reserve?

We need more leaders like Wyoming Senator Cynthia Lummis, who became the first American legislator in history to mention Bitcoin on the Senate floor when she said, “Thank God for Bitcoin!” Lummis has introduced a bill to acquire 1 million Bitcoins over five years as a strategic asset, potentially easing the U.S. national debt burden. And it looks like she’ll have a supporter in incoming President Trump, who sees the value in cryptocurrency—especially Bitcoin.

At the Bitcoin 2024 conference, Trump boldly predicted Bitcoin could one day surpass gold’s $16 trillion market cap. Now he has confirmed interest in creating a federal Bitcoin reserve, which could serve as a shock absorber against financial and geopolitical instability, strengthening the nation’s financial position and signaling a new era of economic innovation and dominance.

We can be encouraged by the idea of a potential executive order from a Trump administration, but any meaningful change will require legislative backing. Executive orders can be reversed by subsequent administrations. Creating a Federal Reserve through the legislative process can solidify a permanent system of Bitcoin investment.

Crypto capital of the planet

There’s one good reason why the U.S. should create a federal Bitcoin reserve: to protect American interests. We already maintain reserves of vital resources—oil, medical supplies, rare minerals, even cheese!—to guard against unforeseen crises. A Bitcoin reserve serves a similar purpose, functioning as a financial shock absorber during economic turmoil.

The time is right to take action. Global power dynamics are in flux with the rise of economic blocs like BRICS. And pro-Bitcoin politicians in the U.S. may only be temporary, with another authoritarian Biden-type presidency always looming on the horizon. Bitcoin offers a hedge against both external and internal threats.

By pushing for Bitcoin reserves at the state and federal levels, the growing pro-crypto movement in America is building the foundations for a more resilient and competitive USA. As Trump said in July at the Bitcoin 2024 conference in Nashville, he wants the United States to be the “crypto capital of the planet.” Indeed, the crypto moment is now.

So, as the saying goes, what’s in your wallet?